If you are working in Dubai or anywhere in the UAE, understanding how to compute your gratuity is crucial. Gratuity, also known as end-of-service benefits, is a financial reward given to employees upon the termination of their employment contract. Today’s article will walk you through the process of calculating gratuity, ensuring you know exactly what you are entitled to.

What is Gratuity?

Gratuity is an end-of-service payment employees recieve after the completion of their employment contract. It serves as a financial cushion for employees during their transition between jobs, resignation, or retirement. Both domestic and expats employees receive benefits of the end-of-service after working for an employer in the UAE.

Gratuity Eligibility Criteria

To be eligible for gratuity, employees must meet specific criteria:

Minimum Service Period: Employees must complete at least one year of continuous service with their employer. If an employee resigns before completing one year, they are not entitled to gratuity.

Employment Violations: Employees dismissed for violations stated in Article 120 of UAE Federal Labour Law no. 8 of 1980 (e.g., forging documents, false identity) or those who leave work without giving notice are not entitled to gratuity.

How is Gratuity Calculated?

Calculating gratuity relies on the employee’s last recorded basic salary, excluding allowances such as housing, transport, and utilities. The calculation formula varies depending on the length of service and the type of employment contract (limited or unlimited).

Calculation Formula

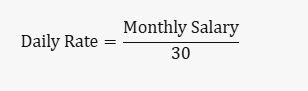

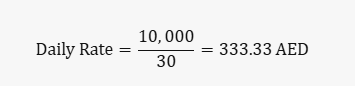

Determine the Daily Rate: Divide the monthly salary by 30.

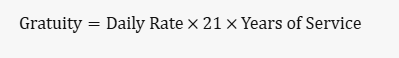

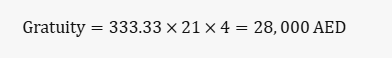

Calculate Gratuity for the First Five Years: Multiply the daily rate by 21 for each year of service.

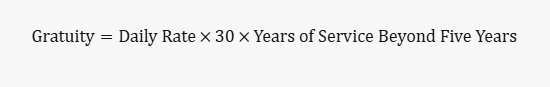

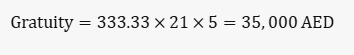

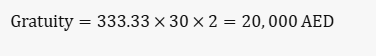

Calculate Gratuity for Service Beyond Five Years: Multiply the daily rate by 30 for each additional year of service.

Example Calculation

Let’s say an employee has a monthly salary of AED 10,000 and has completed four years of service.

Determine the Daily Rate:

Calculate Gratuity for Four Years:

If the employee had completed seven years of service, the calculation would be:

Calculate Gratuity for the First Five Years:

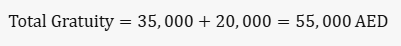

Calculate Gratuity for the Additional Two Years:

Total Gratuity:

Factors Affecting Gratuity Calculation

Several factors can influence the gratuity calculation:

- Unpaid Leave: Unpaid leave days are excluded from the calculation.

- Contract Type: The nature of the contract (limited or unlimited) can affect the eligibility and calculation.

- Termination Reasons: The reason for termination, such as resignation or dismissal, can impact the gratuity amount.

Final Words About Gratuity Calculation

Understanding how to compute gratuity in Dubai is essential for employees to ensure they receive their rightful end-of-service benefits. Follow the steps above, so you can accurately calculate your gratuity and plan your financial future accordingly.

Meet Qazi Raza Ul Haq, a seasoned SEO specialist and content writer with 9 years of experience. Currently based in Dubai, he shares invaluable insights on living and working in the UAE. Passionate about programming, thriller movies, and exploring the UAE, Qazi is your go-to guide for all things UAE.